Our Mission

To improve the learning outcomes and well-being of all children and youth by providing services and leadership in partnership with families, schools and communities.

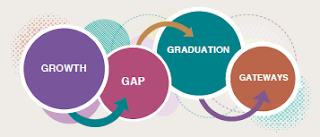

Our Goals

• Increase learning growth for students

• Decrease the gap in achievement

• Increase annual graduation rates

• Increase gateways to post-secondary success

We are being optimistic that the All-Staff Meeting will go on as planned! While you're remote working, take some time to submit a presentation idea! (We've also extended the deadline!)

The Agency is looking forward to another year of employee engagement through staff presentations at our All-Staff Meeting!

Save Aug. 18, 2020, on your calendar for a “most of the day” meeting that will again feature an afternoon of presentations from YOU! Like last year, there will be continued opportunities for staff to showcase their work and accomplishments. Our call for presenters will allow you and your colleagues the option of choosing to present an afternoon session or a morning informational table or both.

- Morning informational tables: If departments or workgroups would like to showcase their work via a table display, that option will be available from 8 to 9 a.m. before the meeting begins.

- Afternoon presentations: 30 minutes in length and can be presented in any format you prefer. Topics can be personal or professional.

How to Submit a Proposal

If you or a team of your co-workers are interested in presenting, complete this presentation proposal by APRIL 30. After all proposals have been submitted, you will be notified if your presentation or table display has been accepted.

When planning your presentation, think about how it reflects, educates, touches on or celebrates in the areas of Connections / Connecting and/or Well-being. Keynote speaker Lyndsey Fennelly will kick off the day with this focus and we’d like the staff presentations to follow her lead. Consider these learning focus areas:

- Connections with staff, student and educators

- Well-being services and supports to students, educators and self

- Celebrating YOU: sharing your successes, what you’re proud of, both professional or personal

- Core Values: Caring - Proactive - Collaborative

- Mission: To improve the learning outcomes and well-being of all children and youth by providing services and leadership in partnership with families, schools and communities

- Wellness: Heartland AEA’s Five Elements of Wellness: Career, Community, Financial, Social, Physical

This approach to learning during our All-Staff meeting gives us a unique opportunity to feel the pulse of the Agency in just a few hours, to connect, learn and celebrate together. These presentations showcase your expertise, your passion and your innovation. So don’t be shy—show your work! Submit your presentation application by April 30, 2020!

If you have any questions, contact the Communications Department.

Be on the lookout next week for opportunities for you to schedule half-hour Zoom meetings with Juliette Houseman, Benefits Specialist, to answer your questions and help you enroll in your benefits selections during selected dates and times in April.

In spite of everything that is going on with COVID-19, our required annual benefits enrollment will still be occurring, so please be sure to check out The Connection for updates and information weekly. As it nears (April 1 - 30), it's time to start reflecting on the different deductible plans offered through Heartland's AEA’s health insurance coverage.

Our online enrollment module in Employee Online has also been updated, and we’ll share more information about this in The Connection as well as through ZOOM sessions for staff. If you know the plan that you want to enroll in, Juliette Houseman, Benefits Specialist, will walk you through the entire enrollment process.

Health Insurance Plan Changes

A reminder of changes to our health insurance plans is below.

A more comprehensive Q & A document will be shared next week. But you can start to consider the following as you think about enrollment:

- When considering which deductible plan you want to participate in, you should consider the deductible amount, premium costs and if you have any expected medical expenses (e.g., having a baby or major surgery). No matter which deductible you choose, there is absolutely NO difference in the actual coverage(s) provided by the Blue Choice plans offered to you.

- If you pay $617.58 per month for the $1,000 deductible family plan vs. $551.10 per month for the $2,000 family deductible plan, you would want to consider the cost savings towards your premium. But you would also want to consider that on the $1,000 deductible family plan, it is $1,000 per person or $2,000 per family towards the deductible, and on the $2,000 deductible plan, it is $2,000 per person or $4,000 towards the deductible. If you don't have any major medical procedures planned, and everyone covered under your plan is in reasonably good health, then you might consider the $2,000 plan because you would save premium dollars and that you would receive an annual Health Reimbursement Arrangement (HRA) with the $2,000 deductible plan only.

- If anyone covered under your plan needs to have any major medical procedures or regularly meets your deductible under the $1,000 deductible plan, then you might consider the savings provided by the lower deductible yet at a higher cost to you.

- If you are considering the single health plans (which are provided by the Agency at no cost to you), which both provide the same coverage, you would want to consider the deductible of $1,000 ($2,000 out-of-pocket maximum) vs. $2,000 deductible ($4,000 out-of-pocket maximum) and that you would receive an annual Health Reimbursement Arrangement (HRA) with the $2,000 deductible plan only.

- The HRA is a 100% contribution by Heartland AEA into a Health Reimbursement Arrangement (HRA) for you if you choose a $2,000 deductible health plan. Contributions are made in quarterly deposits, you can use this money to be reimbursed for your and/or your spouse and/or dependents’ out-of-pocket vision, medical, dental and/or prescription expenses, regardless of whether you have single or family coverage. Since it is a Health Reimbursement Arrangement, you are unable to take the funds with you when you terminate your employment with Heartland AEA, unless you take a bona fide retirement from the Agency (which basically means receiving IPERs). Quarterly deposits will be made into an account with 121 Benefits, the Agency’s HRA administrator. When you submit your claims, if there is money available in your account, you are reimbursed. If you submit more than is in your account, then every quarter when a deposit is made, you are reimbursed until the claim has been paid in full. The balance rolls over annually with no cap on the maximum rollover amount.

As always, contact Juliette Houseman, Benefits Specialist, if you have any questions.

Note: Selected insurance terms are defined at the end of this document.

INCREASED COSTS/IMPACT ON EMPLOYEES

Why are the Agency’s insurance plans changing?

Health care costs in Iowa and across the nation have continued to increase at a rate that exceeds general inflation. Despite these increasing costs, the Agency has managed to maintain consistent premiums since July 1, 2014, and offer comprehensive coverage while minimizing the financial impact on staff contributions. The Agency has made minor changes to insurance plan designs over the past several years. However, in light of a significant increase in insurance claims over the past two years, the Agency needed to update its medical insurance plans.

How will these changes affect employees’ costs?

There are two areas of cost: one is the cost of the insurance premium and the other is the out-of-pocket cost for medical care.

Insurance Premium

The Agency pays 100% of the single premium and 60% of the family premium as part of our compensation packages. To the extent the Agency pays more for insurance premiums, it means there are fewer dollars available to increase salaries and wages. Effective July 1, 2020, the single and family premiums would have increased by nearly 8% had we recommended a status quo approach to the plan designs. For someone with family coverage, that person's share of the monthly premium would have increased $43 to $49 per month, depending on which plan the person elected. By making some changes, the lower deductible plan will have a 0% premium increase and the higher deductible plan will have a 2% premium increase. For those with family coverage on the higher deductible plan, the 2% increase translates to about $11 per month in additional employee costs.

Out-of-Pocket

Out-of-pocket costs vary greatly based on a person's medical usage. The impact will also depend on the medical plan that is chosen. Any change might feel major to employees because it has been several years since we've changed deductibles, co-insurance and out-of-pocket maximums. The emergency room (ER) copay has been $75 for the past several years. Effective July 1, 2020, the ER copay will increase to $150.

DEDUCTIBLES & OUT-OF-POCKET MAXIMUMS

How will the new plans affect the deductibles, co-insurance and out-of-pocket maximums?

In-network Deductibles

The Agency will continue to offer two plans.

Coinsurance

In the lower deductible plan, coinsurance remains unchanged at 15%. Coinsurance will increase to 20% on the higher deductible plan.

In-network Out-of-pocket Maximums (OPM)

PRESCRIPTIONS

What has changed with the approved drug list?

We will continue to use the Wellmark pharmacy program (Blue Rx Complete) for prescriptions under the plan.

How much will my prescriptions cost in the new plan?

The prescription drug plans will have four tiers instead of three tiers.

Why was a 4th tier prescription drug level added?

Prescription drug costs are increasing at a rapid pace. The 4th tier copay was added to help encourage members to seek lower-cost alternatives for both the member and the plan. Medications in the 4th tier are those that have alternatives on lower tiers with similar medical outcomes or are not considered to be medically necessary.

COVERAGES

Are any services no longer covered?

All health and pharmacy (and ancillary if applicable) benefits will remain the same.

What options are available to minimize employee out-of-pocket costs?

Doctor on Demand (DOD) is an affordable and convenient alternative to going to a walk-in clinic. DOD provides a more affordable and time-efficient alternative to a walk-in experience. Virtual visit doctors are Iowa board-certified, and if they refer you to a clinic visit then you are not charged by DOD.

Since DOD is not considered out-of-network, you can complete a virtual visit and get your prescription at a participating pharmacy regardless of whether you are in Iowa or traveling out of state.

PROVIDER NETWORK

How will these changes affect the provider network?

We will continue to use the Wellmark Blue Choice provider network for both plans.

TAXES

What are the tax implications related to these increases?

Insurance premiums paid by the employer are tax-free. The portion of family premiums paid by employees is deducted from paychecks before taxes are calculated. Out-of-pocket medical costs can be paid by the employee with pre-tax dollars to the extent the employee sets aside dollars in the Agency’s “flex medical” plan during the open enrollment period each April.

DIFFERENCES IN PLANS BASED ON EMPLOYEE TYPE

Do these changes affect all employees or just certain employee groups?

All employees are offered the same medical insurance choices, regardless of their workgroup. Employees can choose single or family coverage for either of the two plans. Employee benefit summaries for each employment group are available on the intranet.

Which employee groups receive free family insurance and additional money for the HRA? Effective July 1, 2020, all employees are treated the same for insurance premiums and HRA contributions.

OPTING OUT

Can employees opt out of agency insurance if they have insurance coverage through a spouse's family plan?

Yes. Under Iowa law, employees can opt-out of the Agency’s insurance plan. They will need to sign a Declination Waiver provided by the Benefits Specialist. Employer-paid single coverage is offered to all full-time employees. The Agency provides no incentive for employees to opt-out of the insurance plan. It is likely that some employees have double coverage because of a spouse’s insurance plan.

HOW THESE PLANS WERE DETERMINED

These are big increases across the board. Shouldn’t we have made small adjustments over the past few years rather than wait to make these large changes in one year? Were these decisions made as a result of consulting employees?

The recommendations were supported by the Insurance Committee at its last meeting on Jan. 24, 2020. The Committee worked collaboratively with the Agency’s employee benefits consultants and a Wellmark Blue Cross/Blue Shield Account Manager. In February 2020, the Agency’s board of directors approved the Insurance Committee’s recommendations. Going forward, the Agency intends to consider insurance plan design changes every three to five years rather than making smaller changes each year.

INSURANCE COMMITTEE

Who are the insurance committee members and what groups do they represent in the agency?

Keri Renze and Doug Olson -- Certified Union

Teri Hazen -- Classified Union

Doug Schuster and Steve Jordan -- Classified Non-Union

Nia Chiaramonte and Brian Whalen -- Leaders

Juliette Houseman -- Benefits Specialist

Kurt Subra -- APC

ADDITIONAL SUPPORT TO THE AGENCY

In addition, our employee benefits consultants participate in our annual health insurance decision-making process by providing research, data, usage, industry trends, and more. The Wellmark BC/BS account manager assigned to our account is also a partner and participates in most insurance committee meetings.

CHOOSING YOUR MEDICAL PLAN

What would be the advantages or disadvantages of moving from the higher deductible to the lower deductible?

The answer to this question varies by individual. A few considerations for an employee (and their spouse and/or dependents, if applicable) should include the following: single or family coverage, pregnancy or planning a surgery, specific higher cost health conditions, and/or regular use of prescription drugs. The prescription copays should be reviewed based on what the employee or family member utilizes.

I’m enrolled in the higher family deductible plan now, but I want to drop to the lower family deductible for this next year due to the increases. However, the following year I may want to go back to the higher family deductible plan. How does this affect my HRA? Can I drop to the lower deductible plan this year and elect the higher deductible plan the following year?

Each April during the Agency’s annual enrollment period, an employee can decide which deductible plan to enroll in for the following benefit plan year which begins on July 1. HRA contributions are made on behalf of employees enrolled in the higher deductible plan. If an employee receives HRA contributions and then the following year decides to drop to the lower deductible, the employee still has access to his or her HRA, but no HRA contributions are received when the employee is enrolled in the lower deductible plan. If the employee moves back to the higher deductible plan the following year, then the HRA contributions resume.

HRA CHANGES

What is happening with the HRA?

Effective July 1, 2020, HRA contributions will be the same for all employees electing the higher deductible plan. Employees with single coverage will receive $900/year and employees with family coverage will receive $1,920/year.

Why is there such a huge increase in HRA for family/union?

The IRS has special rules for self-funded employee benefit plans. The Agency needed to address the discrepancy in HRA contributions between the union and non-union employees who participate in family insurance coverage.

Is the HRA pushing up the costs of the medical plan?

No. The HRA is intended to be a benefits equalizer. The HRA is not funded by the medical plan.

INSURANCE TERMS

Premium: The amount the Agency and you pay for your health insurance coverage every month. The employer-paid portion is a tax-free benefit. The amount you contribute towards the family insurance premium is deducted pre-tax from your paycheck.

Deductible: The amount of medical costs that you pay at 100% before coinsurance is applied. Even though the Agency’s fiscal year is July 1 - June 30, the insurance industry accounts for deductibles and out-of-pocket maximums based on a calendar year. Those who have met their deductibles by June 30, 2020, will now have higher deductibles to meet between July 1 and December 31.

Coinsurance: Once you’ve met your deductible, this is the percentage of medical costs for which you are responsible for covered services until you satisfy your out-of-pocket maximum. Effective July 1, 2020, the coinsurance percentage on the lower deductible plan will remain at 15%. Coinsurance will be increased to 20% on the higher deductible plan. Coinsurance also applies to office visits unless it is waived by the plan for preventative services.

Out-of-pocket maximum: This is the most that you will be required to pay out of pocket for covered medical expenses during a year. This includes your deductible and coinsurance payments. For prescription drugs, your copays will accumulate up to a separate out-of-pocket maximum of $3,600. Expenses that do not count towards your in-network out-of-pocket maximum(s): monthly premium contributions, expenses not covered by your plan, and out-of-network expenses. Once you have paid the maximum out-of-pocket amount, your insurance should pay 100 percent of your covered medical expenses.

Copay: An out of pocket cost that applies to prescription drugs in the Agency’s plans. The copays accumulate towards the prescription drug annual out-of-pocket maximum.

Covered person: This is any person who is eligible to receive benefits on your health insurance plan. This would include the policy owner (you) and any family members covered by your plan.

Explanation of Benefits (EOB): This document is an account statement and not a bill. After you make a claim on your policy and the insurance company has made a payment, you will receive an EOB in the mail. It will explain the actions the insurer took on the claim, the available benefits, your portion of the cost and, if necessary, any reasons for denying the claim. The EOB also explains the claims appeal process.

This information is being shared from each of Iowa's AEAs with school administrators and on social media to promote the resources AEAs have available.

As students will be doing more learning and reading from home, there are abundant helpful resources for parents and students through your local Area Education Agency (AEA). Iowa’s AEAs provide a broad variety of digital content for students, teachers and families selected by Iowa educators. Students and teachers are familiar with these vetted, age-appropriate and high-quality digital resources and use them in their daily work.

These resources can be found in the Library & Digital Resources on our website.

There are read-aloud ebooks, ebooks, digital audiobooks, videos, encyclopedias, articles, newspapers and more for our youngest and oldest learners. Many of our resource vendors have suspended the username and password requirement during this time, so access is even easier than before.

*As a friendly reminder, do not publicly post or share usernames/passwords.