Our Mission

To improve the learning outcomes and well-being of all children and youth by providing services and leadership in partnership with families, schools and communities.

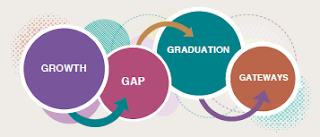

Our Goals

• Increase learning growth for students

• Decrease the gap in achievement

• Increase annual graduation rates

• Increase gateways to post-secondary success

The IRS has announced that the 403(b) and 457 plan regular elective deferral contribution limits will increase for 2019:

- The regular elective deferral limit will be $19,000 per calendar year, increased from the previous $18,500.

- The catch-up contribution limit for employees age 50 and over remains the same at $6,000 per calendar year.

Both the 403(b) and 457 plans offer additional catch-up contribution provisions. A calculation is required to determine the actual amount, if any, available under these special catch-up provisions. If you have any questions, contact Steve Jordan, Senior Payroll Specialist, at ext. 14908.

Juliette Houseman, Benefits Specialist, continues to address some of the questions being submitted from the Benefits Survey.

Remeber that completion of the survey is also a required baseline item for completing this year’s Wellness Program. The survey will be open from Sept. 1, 2018 through May 31, 2019. The Agency’s Insurance Committee uses this information when considering employee benefits, so be sure to complete the survey and let your voice be heard!

Take the Survey

Q: I had a CAT scan after an abnormal mammogram, and it cost well over $300 out-of-pocket. Why?

A: CAT scans billed as outpatient or when the provider of the scan is tied into a hospital are typically higher and can cost a patient up to 100%. It is a good practice to check with the CAT scan provider prior to the procedure. HRA monies can be used to pay for these types of out-of-pocket costs.

Q: Why can’t we increase the limit on our Medical Flex spending accounts?

A: The amount of money you can put into your Medical Flex spending account is an IRS regulation, so unfortunately, Heartland AEA is unable to change the limit.

Q: Can our dental plan offer a higher annual maximum coverage amount?

A: Heartland AEA offers comparable coverage to other employers according to Delta Dental’s Book of Business. In fact, our agency has a higher benefit period maximum of $1,500. According to Delta, most employers have a benefit period maximum of $1,000. Also, higher maximums equal higher premiums.

The Financial Fitness Challenge has been extended through Dec. 31, 2018. Take advantage of it today!

As part of this year’s Wellness Program, we’re pleased to provide a new employee benefit for this year – a free financial fitness program to help you improve your financial well-being. This program is designed to provide a custom-tailored program just for you.

Making changes may seem complicated, but you’ll be surprised how taking a few simple steps will boost your confidence. You can take control of your financial future with this award-winning financial fitness program that includes:

• The Financial Fitness CHECKUP helps you understand where you are now.

• The Financial Fitness ACADEMY includes hundreds of tools and tutorials that will guide you on how to make the most of your money.

Don’t let the worry of financial mumbo-jumbo stop you. The resources were developed to be interesting and understandable! You will feel more empowered and capable of making changes and future financial decisions.

Check it out today on the Financial Fitness Academy website.

If you have any questions, contact Tony Chiaramonte, Director of Human Resources.