Our Mission

To improve the learning outcomes and well-being of all children and youth by providing services and leadership in partnership with families, schools and communities.

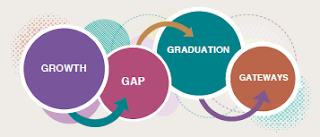

Our Goals

• Increase learning growth for students

• Decrease the gap in achievement

• Increase annual graduation rates

• Increase gateways to post-secondary success

Have a question, comment or concern? Grab a co-worker and join chief administrator Jon Sheldahl for a “Chat with the Chief!”

Region 1

March 13, 2020

8 – 9 a.m.

Guthrie Center Library, Guthrie Center

Zoom link

Region 2

May 12, 2020

8 – 9 a.m.

Adel Regional Office

Large Conference Room

Zoom link

Region 3

May 11, 2020

8 – 9 a.m.

Simpson College, Indianola

Kent Campus Center, 2nd floor

Zoom link

Regions 4 & 5 and Johnston Campus Staff

Feb. 14, 2020

Noon - 1 p.m.

Johnston REC

Conf. Rooms 107A/B

Zoom link

Region 6

March 23, 2020

8:30 – 9:30 a.m.

Johnston REC

Conf. Room 125

Zoom link

Region 7

Feb. 17, 2020

11:30 a.m. – 12:30 p.m.

Ames Regional Office

Conf. Rooms A/B

Zoom link

Region 8

May 7, 2020

3 – 4 p.m.

Newton Regional Office

Room 248B

Zoom link

Shelter Care Staff

May 20, 2020

3 – 4 p.m.

Johnston REC

Conf. Room 123

In December 2017, the Tax Cuts and Jobs Act was signed into law. In general, the impact of this legislation was to reduce the amount of federal income tax withholding from your paycheck beginning in January 2018. Other elements of this law were to increase the standard deduction, limit the deduction for state and local income and property taxes and eliminate personal exemptions.

For over 30 years, employees have provided employers with Form W-4, Employee’s Withholding Certificate, that has directed employers to withhold federal income tax from paychecks based on marital (filing) status and the number of personal exemptions. Beginning Jan. 1, 2020, Form W-4 has been redesigned to remove personal exemptions and align the withholding process more closely to the Individual Income Tax Return, Form 1040.

If you are having the right amount of federal income tax withheld from your paycheck based on the now old marital (filing) status/number of personal exemptions, you don’t need to do anything. Your withholding will continue based on your previously submitted Form W-4—based on marital (filing) status/number of personal exemptions. If you want to make a change to your federal income tax withholding from this point forward, the number of personal exemptions will no longer be part of the withholding calculation.

Here at Heartland AEA, you make changes to your federal (and state) income tax withholding via Employee Dashboard > Employee Online > Tax Information (in the left-hand navigation section). This application has been changed to mirror the new Form W-4. You can link to the paper Form W-4 and its instructions for the Tax Information application.

Before making a federal income tax withholding change, click on the Federal W-4 Form link and carefully read the instructions. The intent of the redesigned W-4 is to increase the accuracy of your withholding. Depending on your current marital (filing) status/number of personal exemptions, your withholding change may produce unexpected results if you don’t read the instructions carefully. On the online withholding application, you must complete Step 1. Although Steps 2 through 4 are optional, completing them will help ensure that your federal income tax withholding will more accurately match your tax liability. Step 2 is for households with multiple jobs, Step 3 is used to claim tax credits for dependents, Step 4 is for other adjustments (e.g., additional income such as interest and dividends, itemized deductions that exceed the standard deduction and extra tax you might want to be withheld). You can change your withholding as often as you want/need through the Employee Online > Tax Information application.

The Internal Revenue Service (IRS) highly recommends employees do a paycheck checkup via their Tax Withholding Estimator. This process will require your most recent pay stub and most recent tax return. This link to the IRS FAQs may also be helpful as you contemplate a federal income tax withholding change. If you have specific questions about your personal tax situation, contact your tax advisor.

State Income Tax Withholding

The state of Iowa continues to base state income tax withholding on marital (filing) status and the number of exemptions. There has been no change to the Iowa state income withholding calculation. However, the state has updated the withholding tax tables for 2020. This will generally mean a slight decrease in the amount of state income tax withholding from paychecks beginning Jan. 1, 2020. Likewise, the federal income tax withholding tables have been adjusted for inflation, resulting in a slight decrease in federal income tax withholding.

The “What If” calculator on our Employee Online application has been removed as our software provider has not yet made changes to this tool based on the new federal Form W-4. We don’t know when, or if this functionality will return. We’ll let you know if it becomes available again in the future.

If you have any questions about this information, contact Steve Jordan, Senior Payroll Specialist, at ext. 14908.

Iowa Department of Education Director Ryan Wise announced last week that the draft of Iowa’s state plan for meeting requirements of the federal Strengthening Career and Technical Education for the 21st Century Act is available for public review and comment.

Commonly referred to as Perkins V, the federal law reauthorizes the Carl D. Perkins Career and Technical Education Act of 2006, which provides almost $1.2 billion in federal support for career and technical education (CTE) programs in all 50 states and U.S. territories, including support for integrated career pathway programs for students.

Iowa receives nearly $12 million annually in federal Perkins funds, divided between secondary and postsecondary CTE programs delivered through public school districts and community colleges. CTE programs increase student engagement through the integration of technical and academic skills in hands-on, real-world learning experiences.

“This federal law aligns well with our new state standards and efforts already underway to expand access to high-quality CTE programs and better prepare students for higher-level academic and technical training,” Wise said. “Iowa’s plan creates efficiencies, broadens opportunities for students and educators and positions CTE as a driving force for education, workforce and economic development.”

The Department has received input on the development of the plan through a state advisory council, education work teams and written comments.

The draft of Iowa’s state plan incorporates this input and includes strategies for addressing the following new key priorities:

- Expanding high-quality CTE programs to middle school students.

- Focusing on teacher recruitment, retention and professional development, particularly in the area of work-based learning.

- Growing career and technical student organizations across the state to enhance classroom learning through real-world experiences.

These efforts support Iowa’s Future Ready Iowa initiative, which focuses on ensuring Iowa’s workforce is equipped with the skills and education that employers need.

Iowans are invited to give feedback on the state plan, and the related secondary and postsecondary accountability performance targets, through two online surveys, which are open through Feb 13. In addition, three town hall meetings will be held in Cedar Rapids, Council Bluffs and Johnston from 4:30-6:30 p.m. on Feb. 6. Those who are unable to attend the town hall meetings can tune in online for an overview of the draft plan and can provide written feedback through the online survey.

Feedback also can be submitted by mail: Iowa Department of Education, Attn: Eric St Clair/PerkinsV Feedback, Grimes State Office Building, 400 E. 14th St., Des Moines, IA 50319-0146.

Comments will be considered in the final state plan, which will be presented to Gov. Kim Reynolds for approval prior to submission to the U.S. Department of Education in April.

Back for January…The Heartland AEA online store where staff can redeem their Wellness incentive for agency logo apparel is open for ALL employees today through Jan. 31, 2020! Employees who have earned their $40 coupon towards logo apparel will receive a separate email with specific ordering information once Interactive Health has notified us.

But new this year—all employees can purchase any items in the store (and shipping) at their own cost during the two-week period when the online store is open monthly through June 2020. Important reminder: if you are not ordering apparel with your Wellness credit, you’ll need to pay for shipping using Spee-Dee Delivery or UPS or pick up your purchase at P&M Apparel in Polk City. Keep your eye on The Connection for the link and monthly online store order dates!

P&M Apparel Heartland AEA Online Store

If you have any questions, contact Juliette Houseman, Benefits Specialist.

While IEP teams are not required to use agendas for IEP meetings, there are many reasons why using a shared agenda would be useful, including:

- Helping the facilitator prepare for the meeting

- Ensuring all required topics are covered

- Encouraging attendee participation

- Helping with the flow of conversation to keep meetings efficient and timely

To that end, a new IEP meeting agenda tool has been created that follows the flow of the Iowa IEP and addresses the required components of an IEP.

Two different agenda samples are being provided.

Agenda 1: Is a customized agenda for the IEP meeting facilitator. The facilitator’s agenda includes specific discussion points such as setting the meeting purpose given the type of meeting occurring and actions to occur at the conclusion of the meeting.

Agenda 2: Is a team agenda for use by all members. It is important the facilitator consider the priorities of the team and age of the student when setting the order of agenda items.

While the use of an IEP meeting agenda is encouraged, we want to remind you that this tool is optional for use. If you have any questions, contact Sara Mercer, Special Education Supervisor.